Consumers are demanding more environmentally-friendly products; Minnesota plastics manufacturers are paying attention.

The recently-released Renewable Materials Report for AURI, conducted by the Russell Herder research and public relations firm in Minneapolis, found that more than half of Minnesota plastics manufacturers surveyed say consumer demand for environmentally-friendly products is going to impact their business. More than 80 percent agree it will be important for their business to help meet the demand.

A few Minnesota manufacturers have already accepted the challenge, such as Bio-Plastic Solutions, LLC in Blooming Prairie, Minn. The furniture and building components manufacturer is one of the nation’s first to blend corn-starch based polylactic acid (PLA) with petroleum polymers to make extruded-plastic furniture trim, drywall corner bead and interior wall guards. Vinylite, a windows and doors manufacturer in Fergus Falls, Minn., is developing a soy-based polyoil insulation for window frames.

Harold Stanislawski, executive director of the Fergus Falls Economic Improvement Commission, is leading an effort to help west central Minnesota manufacturers use renewable polymers. Companies such as Shore Master of Fergus Falls, makers of boat docks and other marina products, are interested in incorporating biomaterials if they are competitive on price and performance.

Dennis Timmerman, AURI project director, says bioplastics have the potential to add significant value to crop byproducts. AURI wants to support the industry by helping manufacturers overcome obstacles, he says. “How do we help them gain a competitive advantage?”

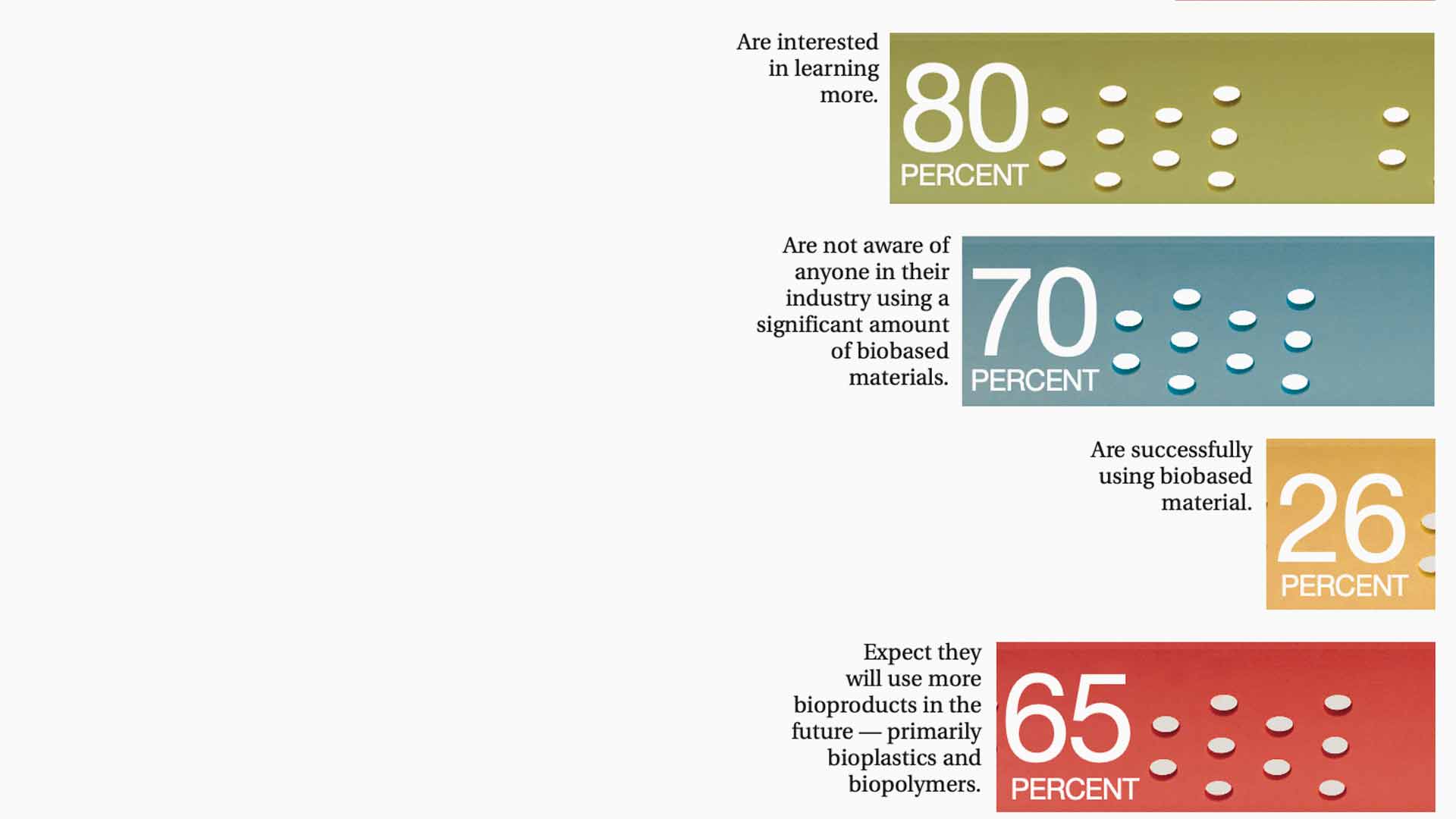

AURI initiated the renewables study, in part, to gather feedback from Minnesota plastic manufacturers on their interest in using biomaterials and challenges that need to be overcome. The Minnesota Soybean Growers Association helped fund the study.

“We want to find out: what’s the size of the opportunity for biobased products?” Timmerman says. “Do (manufacturers) realize there are bioproducts out there? If so, what qualities would they like to see? And are they willing to pay more?”

In addition to manufacturer survey results, the nearly 100-page AURI report includes an exhaustive literature review of U.S. and global bioplastics feasibility and market studies. It should be available to the public by late May.

More research needed

Most manufacturers surveyed (79 percent) said their primary concern is bioplastics’ ability to meet testing standards and consumer specifications.

Marvin Windows and Doors in Warroad, Minn., is committed to using eco-friendly materials such as wood-plastic composites but is concerned that bioplastics are not yet durable enough for outdoor use. “Materials using resources such as corn are typically more interior; they do not have good moisture resistance, says Ben Wallace, a Marvin research manager. “That is changing; they are getting better.”

“If it is an equal cost, it is pretty easy to choose the better, more sustainable biobased material assuming the performances are equal,” Wallace says. However, manufacturers are not going to sacrifice performance. “If we are having to produce that part two or three times in a life cycle of a window to replace it, that is not going to

be viable.”

Manufacturers such as Marvin and Vinylite have to meet the testing standards of the American Architectural Association, ASTM and other agencies. Products used in northern climates have to hold up to extreme cold during shipping, storage and outdoor use. When manufacturers use new raw materials, they must consider impacts on warranties, additional equipment costs, and the organization’s capacity to fully test new products.

Manufacturers say they are taking a risk using biomaterials that haven’t gone through rigorous testing and years of use. The approval process for a new product is expensive; trials can take eight to 15 months.

“We need to address these issues,” Timmerman says. Manufacturers may be reluctant to bring bioproducts to the market because “they don’t want to face recalls.”

Factoring in price and supply

Almost half of manufacturers surveyed are concerned that biomaterials may be prohibitively expensive. On average, they are willing to pay 9 percent more for bio- verses petro-based raw materials. Any more, and manufacturers can’t compete — especially those in the home construction industry, which hasn’t rebounded from the recession.

“We’re hearing from our salespeople and customers that there is not a lot of pressure for green materials,” says Mike Rone of Northern Contours, makers of cabinet doors and furniture fixtures.

“Economic conditions in general have put companies in survival mode — and they are not particularly interested in the increased costs involved with paying for something ‘green.’ Nobody is going to pay a 20 percent premium,” but they “may pay three to five percent more.”

An ample and consistent supply of biomaterials is also a concern for 34 percent of Minnesota manufacturers surveyed. For example, Excel Plastics in Fergus Falls, Minn. makes point-of-purchase displays for retailers and needs a one-sixteenth-inch thickness, but there isn’t an

available supply.

Opportunity still abounds

Despite the challenges, incorporating bioproducts into product lines could be a new revenue stream for Minnesota manufacturers, the AURI study finds. The greatest opportunities are in pressure-sensitive adhesives, foam, hardened plastics, packaging and some non-load-bearing molded products.

AURI is helping overcome challenges by working with researchers at Winona State University and North Dakota State University to improve ag-based polymers’ durability.

“We are fortunate to have this group of manufacturers that see the advantages of these products and are willing to work with Winona and NDSU to resolve these problems,” such as strength and heat resistance, Timmerman says. “I think we can get there, but like any new process, it’s by trial

and error.”

The value-added rewards of turning crop byproducts into plastics could be huge. “We are starting to understand the value chain and opportunities that exist for Minnesota,” Timmerman says. For the agricultural industry, bioplastics have “the opportunity to add even more value than fuel.”